Investment

Why Invest in

Natural Fancy

Color Diamonds?

In recent years, increasing attention has been focused on purchasing diamonds for investment purposes. Diamonds offer many advantages to investors:

- A hard asset that can hedge against inflation and the de-valuation of fait money.

- Low correlation to other asset classes and almost zero correlation to equities.

- Stable long-term returns and much lower volatility than traditional asset classes.

- Potential for substantial long-term returns due to a supply-demand imbalance.

Color diamonds in particular offer an incredible opportunity for profit over the long term as the supply-demand balance is more acute than in the white diamond market. Supply is exceedingly tight and likely to get tighter. Only 1 in 10,000 carats mined are fancy color, so very little new supply enters the market each year. Looking forward, many of the major mines producing fancy color diamonds are near the end of their productive lives, so supplies are expected to become even more restricted in the future. At the same time, demand for color diamonds among the wealthy, collectors and investors – is far outstripping the supply. Color diamonds offer the potential for truly tremendous gains for the astute purchaser.

As a result, color diamond sales at auction continue to make not just headlines, but to break record after record.

Portability

Natural Fancy Color Diamonds meet the qualifications of being both an investment and as a thing of beauty to be enjoyed, similar to a piece of art. An individual can actually derive enjoyment from his/her diamond investment, unlike other traditional investments such as bonds, stocks, or even other financial products.

Multipurpose Asset

Natural Fancy Color Diamonds meet the qualifications of being both an investment and as a thing of beauty to be enjoyed, similar to a piece of art. An individual can actually derive enjoyment from his/her diamond investment, unlike other traditional investments such as bonds, stocks, or even other financial products.

Multipurpose Asset

Natural Fancy Color Diamonds meet the qualifications of being both an investment and as a thing of beauty to be enjoyed, similar to a piece of art. An individual can actually derive enjoyment from his/her diamond investment, unlike other traditional investments such as bonds, stocks, or even other financial products.

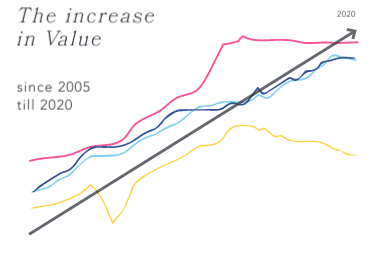

Investment in Fancy Color Diamonds(FCD)

In the past 37 years, FCDs has not dropped.in 2008 when gold fell 30% and white diamonds dropped 20% but FCDs have not experienced a price setback.

Just 1% of the world’s total “rough” diamond production is made up of Fancy Color Diamonds, making them the rarest of the rare.

The most famous blue diamond is the Hope Diamond The large 45.52ct diamond has a long history and was estimated in 2011 to be worth $200-250 million.

3 carat Vivid Pink increased in value by ~383%

1 carat Fancy Blue

increased in value

by ~258%

3 carat Intense Blue ncreased in value by~182%

3 carat Vivid Yellow

increased in value

by ~73%

wants to learn more about FCD investments?

novel collection Investment guide

is available download here > or get hardcopy to your adree for free >